Every little thing You Required to Find Out About Equity Loan

Demystifying the Credentials Refine for an Equity Funding Authorization

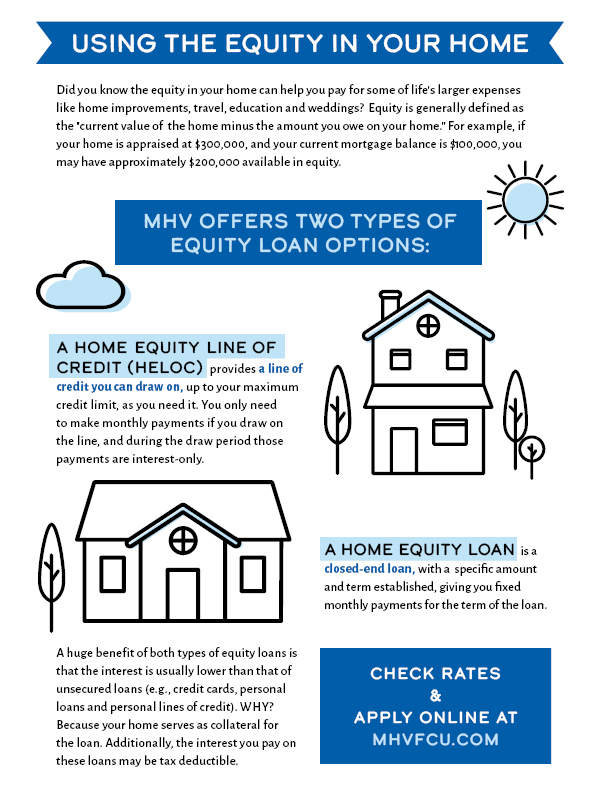

Browsing the credentials process for an equity finance approval can typically appear like deciphering a complex puzzle, with numerous aspects at play that figure out one's eligibility. From rigid credit rating needs to thorough home evaluations, each step holds value in the loan provider's decision-making process. Understanding the interaction between debt-to-income proportions, loan-to-value proportions, and other key criteria is critical in safeguarding approval for an equity finance. As we dive much deeper right into the details of these requirements, a more clear path arises for prospective borrowers seeking financial take advantage of via equity lendings.

Secret Eligibility Criteria

To certify for an equity car loan approval, meeting details key eligibility requirements is essential. Additionally, lenders analyze the applicant's debt-to-income ratio, with the majority of liking a ratio listed below 43%.

Moreover, loan providers examine the loan-to-value proportion, which compares the amount of the funding to the assessed worth of the residential or commercial property. Usually, lenders favor a lower ratio, such as 80% or much less, to reduce their danger. Work and earnings stability are essential consider the authorization procedure, with lending institutions looking for assurance that the consumer has a trustworthy resource of earnings to pay off the lending. Satisfying these crucial eligibility standards increases the chance of safeguarding approval for an equity loan.

Credit History Value

Lenders commonly have minimum debt rating needs for equity lendings, with scores over 700 normally taken into consideration great. By preserving a great debt rating via timely bill repayments, reduced credit utilization, and responsible loaning, candidates can improve their chances of equity finance authorization at competitive prices.

Debt-to-Income Ratio Analysis

Provided the vital duty of credit report ratings in figuring out equity financing authorization, an additional essential aspect that loan providers evaluate is an applicant's debt-to-income ratio analysis. A lower debt-to-income ratio shows that a customer has more revenue readily available to cover their financial debt settlements, making them a more appealing prospect for an equity funding.

Customers with a greater debt-to-income ratio might deal with difficulties in safeguarding authorization for an equity funding, as it suggests a greater danger of skipping on the funding. It is vital for candidates to analyze and possibly lower their debt-to-income ratio prior to using for an equity car loan to enhance their opportunities of approval.

Residential Property Assessment Requirements

Assessing the worth of the building through a detailed appraisal is a fundamental action in the equity financing authorization process. Lenders call for a property appraisal to make certain that the home supplies sufficient collateral for the funding quantity asked for by the consumer. During the residential property assessment, a licensed evaluator assesses various aspects such as the residential property's problem, dimension, place, equivalent property worths in the area, and any kind of distinct features that might impact its overall worth.

The building's assessment worth plays a crucial role in figuring out the optimum quantity of equity that can be obtained against the home. Lenders normally call for that the assessed worth fulfills or goes beyond a particular portion of the financing quantity, referred to as the loan-to-value ratio. This proportion aids alleviate the lending institution's risk by guaranteeing that the residential or commercial property holds adequate value to cover the financing in case of default.

Eventually, a complete residential or commercial property evaluation is necessary for both the loan provider and the borrower to accurately assess the building's worth and figure out the feasibility of providing an equity loan. - Equity Loan

Recognizing Loan-to-Value Proportion

The loan-to-value ratio is a vital financial statistics used by loan providers to analyze the danger related to offering an equity financing based upon the building's assessed value. This ratio is determined by splitting the amount of the lending by the assessed worth of the residential or commercial property. If a residential property is assessed look at here now at $200,000 and the financing quantity is $150,000, the loan-to-value proportion would be 75% ($ 150,000/$ 200,000)

Lenders use the loan-to-value proportion to determine the degree of risk they are taking on by providing a loan. A higher loan-to-value ratio shows a higher threat for the lender, as the consumer has much less equity in the home. Lenders commonly prefer lower loan-to-value proportions, as they offer a pillow in instance the borrower defaults on the building and the funding needs to be marketed to recover the funds.

Debtors can also take advantage of a lower loan-to-value ratio, as it might cause better finance terms, such as lower rate of interest or minimized fees (Alpine Credits Equity Loans). Recognizing the loan-to-value ratio is essential for both loan providers and consumers in the equity lending authorization process

Verdict

In conclusion, the credentials procedure for an equity car loan authorization is based on key eligibility criteria, credit history score value, debt-to-income proportion evaluation, property appraisal demands, and recognizing loan-to-value ratio. Comprehending these factors can help individuals navigate the equity car loan authorization process much more successfully.

Recognizing the interaction between debt-to-income proportions, loan-to-value proportions, and various other vital standards is paramount in securing authorization for an equity car loan.Offered the critical role of credit report ratings in determining equity financing authorization, another vital element that lenders assess is a candidate's debt-to-income proportion evaluation - Alpine Credits Canada. Debtors with a greater debt-to-income proportion may deal with difficulties in securing approval for an equity car loan, as it suggests a higher risk of skipping on the lending. It is important for candidates to analyze and potentially decrease their debt-to-income proportion before using for an equity lending to boost their opportunities of authorization

In conclusion, the certification process for an equity loan approval is based on crucial eligibility standards, debt score importance, debt-to-income ratio evaluation, building assessment needs, and understanding loan-to-value ratio.