VA Home Loans: Exclusive Conveniences for Veterans and Active Duty Solution Members

Browsing the Home Loans Landscape: How to Utilize Funding Solutions for Long-Term Wide Range Structure and Protection

Navigating the intricacies of mortgage is crucial for any individual seeking to construct riches and make certain monetary security. Comprehending the various types of funding alternatives offered, in addition to a clear assessment of one's financial situation, prepares for informed decision-making. By utilizing tactical borrowing strategies and keeping building value, people can improve their long-term wealth possibility. However, the complexities of efficiently utilizing these services elevate crucial inquiries about the most effective methods to comply with and the pitfalls to avoid. What methods can really maximize your investment in today's unstable market?

Comprehending Home Mortgage Kinds

Home mortgage, a critical element of the realty market, been available in various kinds created to fulfill the varied demands of consumers. The most common sorts of home finances include fixed-rate home mortgages, adjustable-rate mortgages (ARMs), and government-backed car loans such as FHA and VA car loans.

Fixed-rate home loans use security with regular month-to-month settlements throughout the funding term, typically varying from 15 to three decades. This predictability makes them a preferred option for novice property buyers. On the other hand, ARMs feature interest prices that rise and fall based upon market conditions, frequently resulting in reduced initial payments. Nevertheless, borrowers have to be prepared for possible boosts in their monthly commitments gradually.

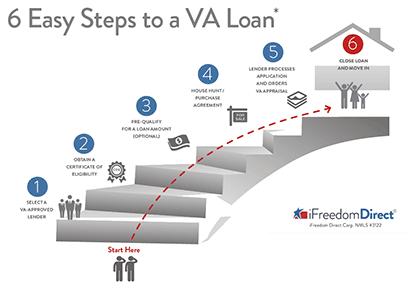

Government-backed finances, such as those insured by the Federal Real Estate Administration (FHA) or assured by the Department of Veterans Matters (VA), cater to details groups and usually require reduced deposits. These finances can help with homeownership for people who might not qualify for traditional funding.

Analyzing Your Financial Scenario

Reviewing your economic circumstance is a vital action in the mortgage procedure, as it lays the structure for making notified borrowing decisions. Begin by assessing your revenue resources, consisting of incomes, benefits, and any type of additional revenue streams such as rental homes or investments. This comprehensive sight of your incomes helps lenders establish your borrowing capacity.

Following, evaluate your expenses and month-to-month responsibilities, including existing financial debts such as charge card, trainee fundings, and vehicle settlements. A clear understanding of your debt-to-income ratio is essential, as the majority of loan providers prefer a proportion below 43%, guaranteeing you can manage the brand-new mortgage settlements together with your present obligations.

In addition, evaluate your credit scores rating, which considerably influences your funding terms and rate of interest. A greater credit history rating demonstrates monetary reliability, while a lower rating may require strategies for enhancement prior to making an application for a finance.

Lastly, consider your cost savings and properties, consisting of reserve and liquid financial investments, to ensure you can cover down repayments and closing prices. By meticulously assessing these elements, you will certainly be much better positioned to browse the home car loan landscape effectively and safeguard funding that aligns with your long-lasting monetary goals.

Approaches for Smart Loaning

Smart borrowing is important for navigating the complexities of the home lending market successfully. A strong credit rating can dramatically decrease your passion prices, equating to considerable cost savings over the life of the funding.

Following, take into consideration the sort of mortgage that finest fits your economic scenario. Fixed-rate car loans use security, while variable-rate mortgages may provide lower initial payments but bring dangers of future rate increases (VA Home Loans). Assessing your long-lasting plans and financial capacity is important in making this choice

In addition, purpose to safeguard pre-approval from lenders prior to residence searching. When making a deal., this not only provides a more visit this web-site clear photo of your budget yet additionally enhances your negotiating position.

Long-Term Wide Range Building Methods

Structure long-term riches via homeownership requires a tactical technique that goes past just safeguarding a mortgage. One efficient strategy is to consider the recognition potential of the building. Selecting homes in growing communities or locations with planned growths can cause substantial boosts in property value in time.

Another vital facet is leveraging equity. As mortgage repayments are made, home owners build equity, which can be used for future investments. Utilizing home equity lendings or credit lines sensibly can offer funds for added property financial investments or improvements that better boost building worth.

In addition, keeping the residential property's problem and making tactical upgrades can dramatically add to long-lasting riches. Easy improvements like up-to-date shower rooms or energy-efficient home appliances can yield high returns when it comes time to sell.

Lastly, recognizing tax obligation benefits connected with homeownership, such as home mortgage interest reductions, can enhance economic end results. By maximizing these advantages and adopting a proactive investment way of thinking, home owners can grow a robust portfolio that promotes long-term wide range and stability. Inevitably, a well-rounded method that focuses on both residential property selection and equity administration is necessary for sustainable riches structure through property.

Maintaining Financial Security

Additionally, fixed-rate home loans provide predictable monthly settlements, enabling better budgeting and economic preparation. This predictability safeguards house owners from the changes of rental markets, which can cause abrupt boosts in housing prices. It is crucial, nevertheless, to make sure that home mortgage repayments remain convenient within the wider context of one's monetary landscape.

In addition, accountable homeownership entails routine maintenance and improvements, which a knockout post secure residential property value and boost general safety and security. Homeowners should additionally think about expanding their monetary profiles, making sure that their investments are not only connected to realty. By integrating homeownership with various other economic instruments, people can create a well balanced approach that alleviates dangers and boosts overall economic stability. Eventually, keeping economic safety via homeownership requires a informed and aggressive strategy that highlights cautious preparation and ongoing persistance.

Final Thought

In conclusion, successfully navigating the home finances landscape requires a comprehensive understanding of why not try these out numerous funding types and a comprehensive assessment of private economic scenarios. Implementing critical loaning practices promotes long-term wealth buildup and protects economic security.

Browsing the complexities of home loans is crucial for anybody looking to develop riches and ensure financial security.Assessing your monetary situation is a vital step in the home loan procedure, as it lays the structure for making notified loaning choices.Homeownership not only offers as a lorry for long-term wide range building however additionally plays a substantial role in preserving economic safety and security. By combining homeownership with other economic instruments, people can develop a balanced technique that mitigates dangers and boosts total economic stability.In final thought, effectively navigating the home lendings landscape demands a detailed understanding of different car loan kinds and a detailed analysis of individual economic situations.